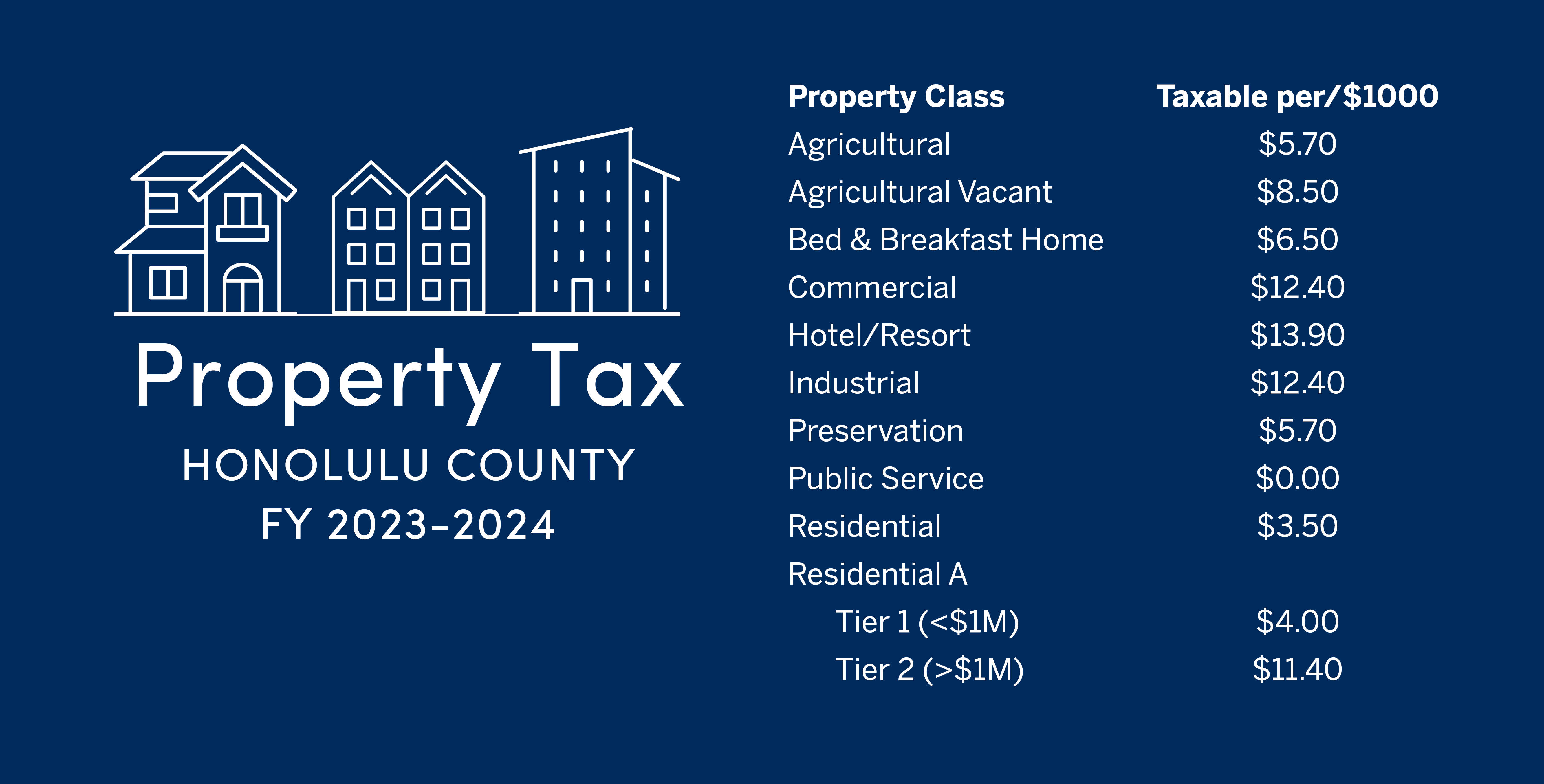

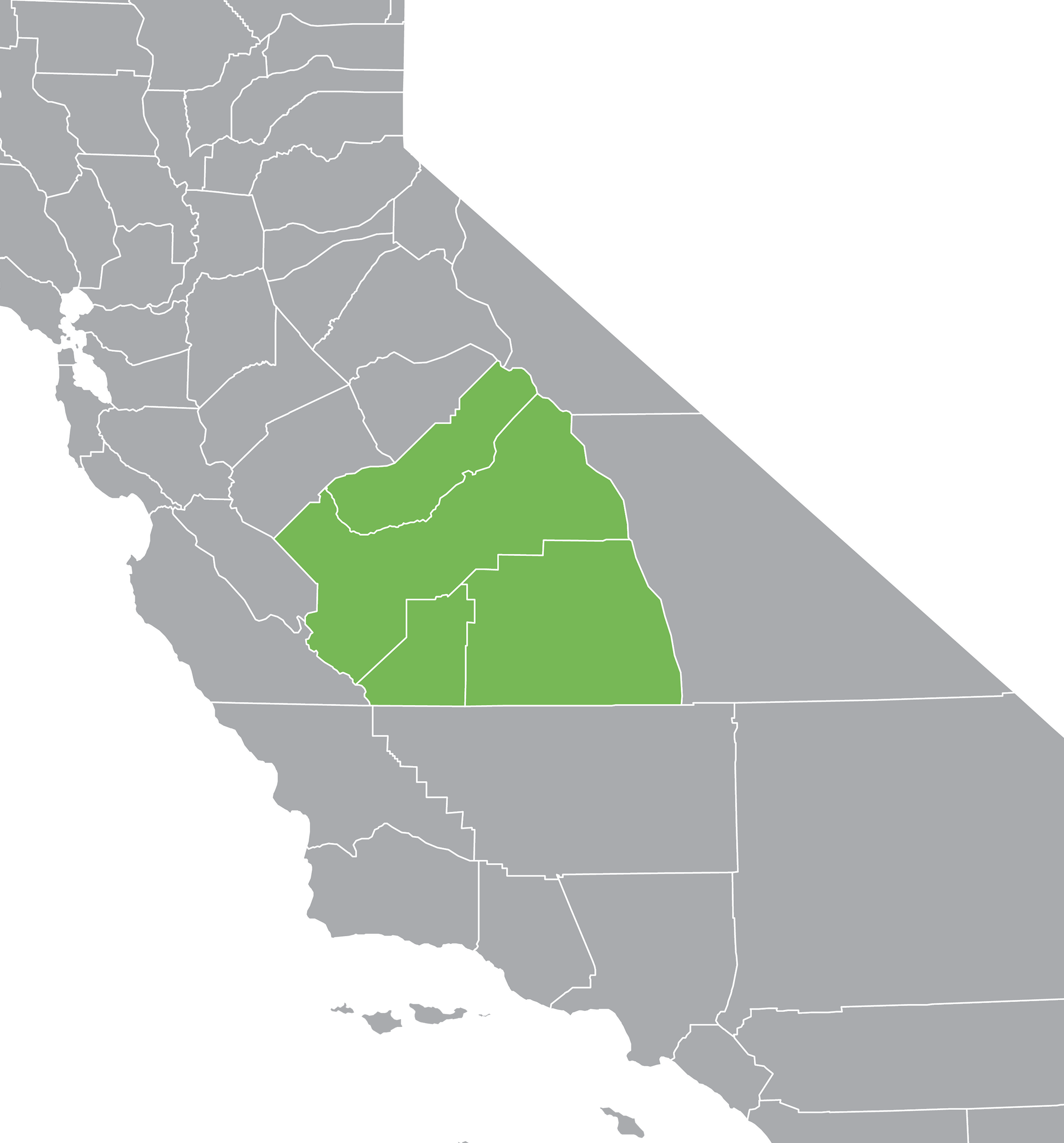

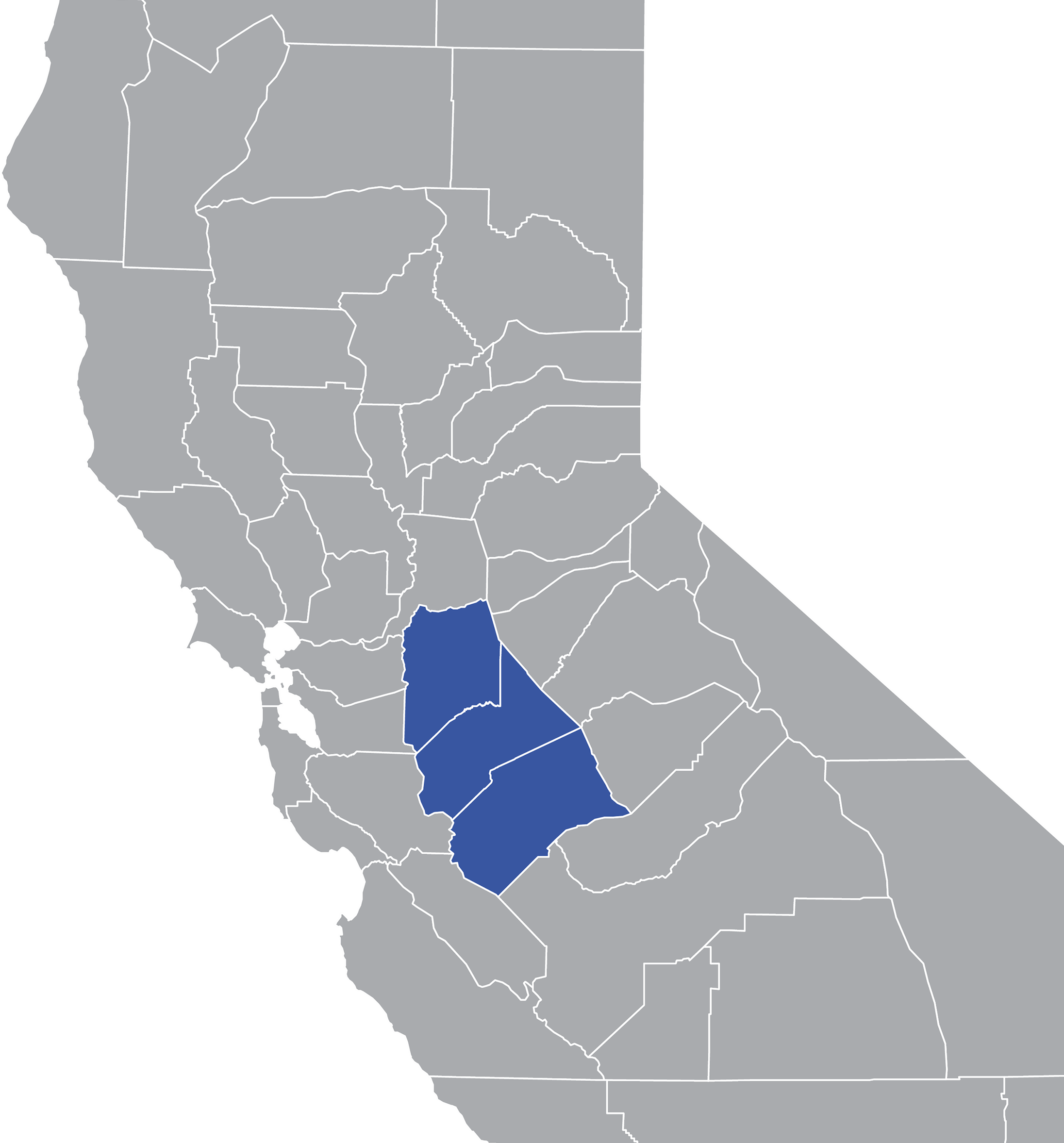

Webthe median property tax in san joaquin county, california is $2,340 per year for a home worth the median value of $318,600. San joaquin county collects, on average, 0. 73% of. Our mission is to ensure the safekeeping of public funds while. Webexplore the charts below for quick facts on san joaquin county effective tax rates, median real estate taxes paid, home values, income levels and homeownership rates, and. Weblearn all about san joaquin real estate tax. Whether you are already a resident or just considering moving to san joaquin to live or invest in real estate, estimate local. Webthe median property tax (also known as real estate tax) in san joaquin county is $2,340. 00 per year, based on a median home value of $318,600. 00 and a median effective. Weboverseeing the property tax billing and collection process for secured and unsecured property taxes levied by california state law, we assist the public in understanding their. Quickly find treasurer & tax collector phone number, directions & services (stockton, ca).

Related Posts

Recent Post

- Shooting In Elmira New York

- Atascosa County Sheriffs Office

- A Demand Curve Quizlet

- Most Inbred States In Usa

- Infection Control Quizlet

- A Balance Sheet Shows Quizlet

- Hhn Ticket

- Fire Department Radio Scanner

- Cochise County Az News

- Morgantown Arrests

- Usaa Spokeswoman

- Www Accessflorida

- Ups Delivery Driver Apply

- Ups Driver Helper Age Requirement

- Side Effects Of Chemotherapy Include Quizlet

Trending Keywords

Recent Search

- Wrong Way Driver Westminster

- Kaiser Permanente Signon

- Matt And Kayla Pickers

- Indeed Working From Home

- Crossdressing Role Reversal

- Chapter 4 Ap Gov Quizlet

- Eos Vs Planet Fitness

- Uiuc Vs Purdue Engineering

- An Autoimmune Disease Is Quizlet

- Eps Tax Refund Status

- Sporting News Week 9

- Houses For Rent In Palm Bay Fl By Owner

- Pistol Brace Vacated

- Quizlet Cranial Nerves

- Sdsu Spring 2025 Application Deadline

/state-income-tax-rates-2-2014-tax-foundation-57a631e35f9b58974a3ad3a4.png)