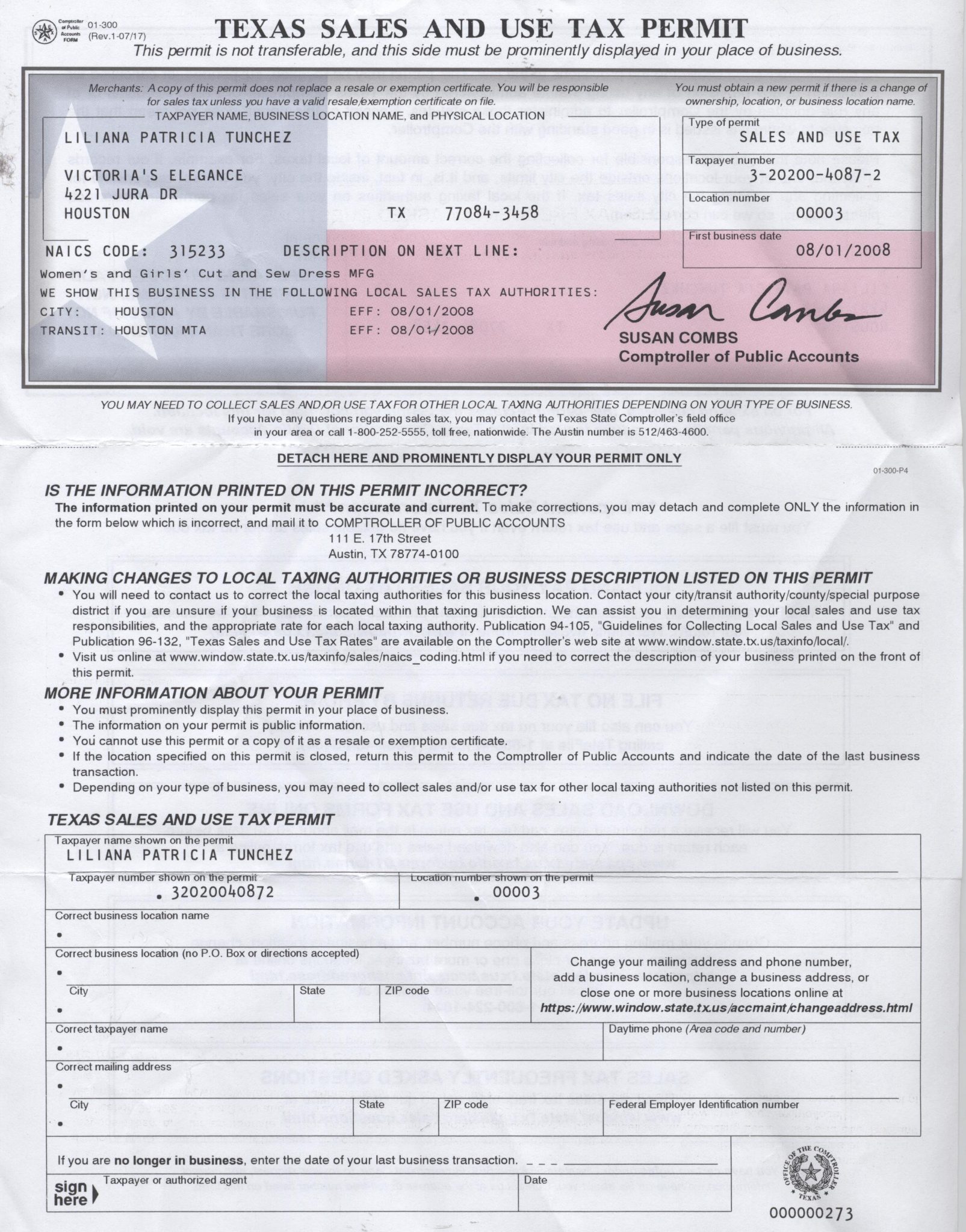

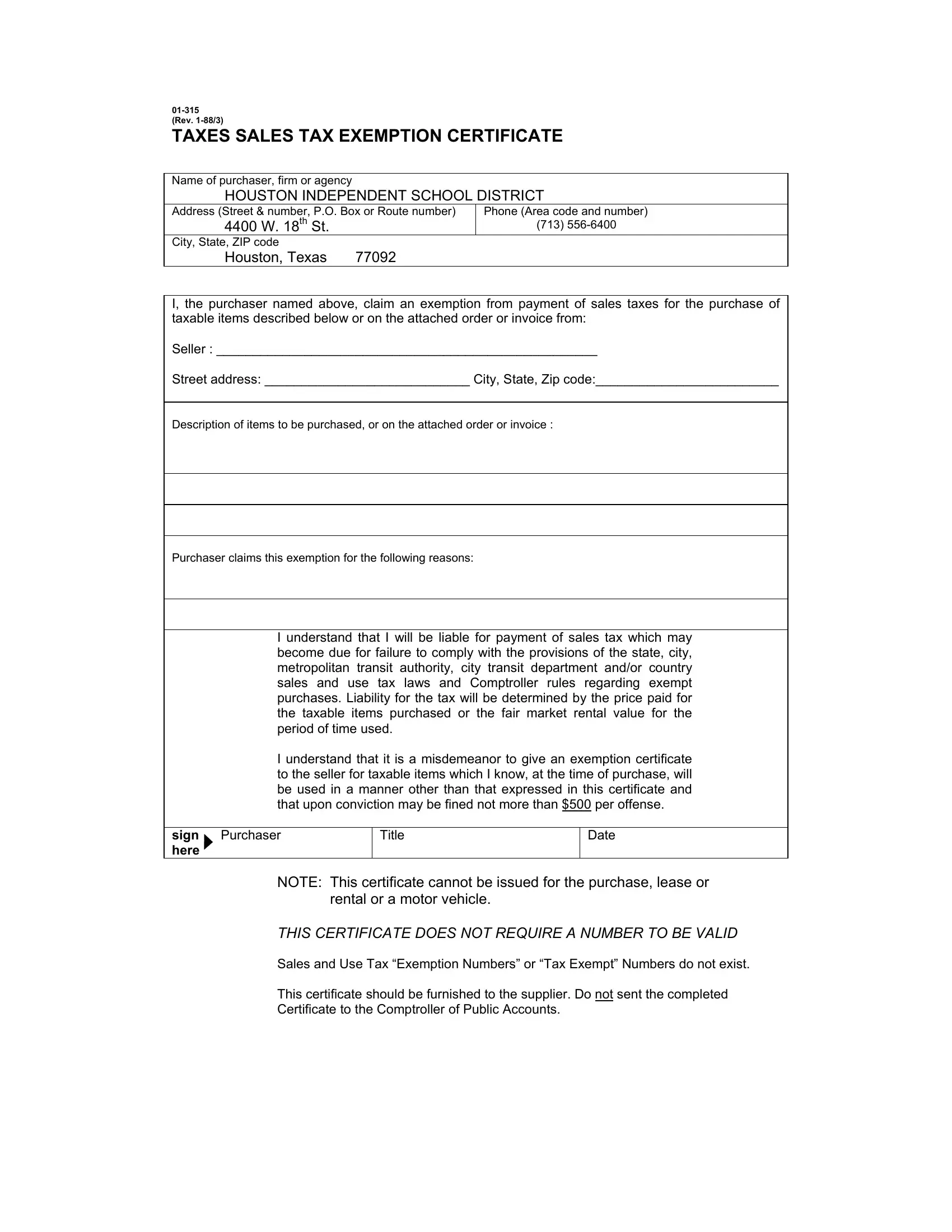

Webhow are vehicle sales taxed in texas? Texas sales tax on car purchases: Vehicles purchases are some of the largest sales commonly made in texas, which means that. This powerful tool simplifies the process, providing. Webtexans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of 6. 25 percent on the purchase price or. Webmotor vehicle sales tax is due on each retail sale of a motor vehicle in texas. A motor vehicle sale includes installment and credit sales and exchanges for property, services. Weball texans who buy a used vehicle from anyone other than a licensed car dealer must pay sales tax on the vehicle's standard presumptive value, which is determined by using the.

Recent Post

- Thinscape Countertop Pros And Cons

- Space Center Weather

- Seth Thomas Clocks Website

- Third Nipple Spiritual Meaning

- Tvokids Inflation

- Casa Grande Az Obituaries

- Newcomerstown Obituaries

- Apartments For Rent In Bradenton Fl Under 800

- Meijer Shoe Sale 2023

- Motels To Rent

- Dirty Hump Day Jokes

- Jason Fernandes Moorpark

- Apartments And Houses For Rent

- House For Rent In Granada Hills

- Zazzle Flags

Trending Keywords

Recent Search

- Kenshi Town

- Securus Messaging

- Support Desk Analyst Salary

- Kwat Outdoors Fishing Report

- Can You Drop Off Uhaul At Different Location

- Manscaping Phoenix

- James Mullarney Wiki

- Iep Independent Functioning Goals

- River British Youtuber

- Busted Newspaper Morton County Nd

- Amazon Vnj3

- Dr Berman Bbl

- Miami Dade County Eviction Search

- Ups Second Ave

- Miami Dade Jail Records